Best retirement calculator for married couples

Make Travel a Detailed Part of Your Overall Retirement Plan. This calculator also assumes that you make your entire contribution at the end of.

1

The Best Retirement Calculators for Couples.

. Our retirement calculator takes into account the average Canadian retirement income from the Old Age Security OAS and Canada Pension Plan CPP for 2018. If both spouses work they may move into a higher tax bracket or be affected by the Additional Medicare Tax. They can use the IRS Withholding Estimator on.

With that in mind there is a clever tax arbitrage strategy people can implement if they also have an IRA. After getting married couples should consider changing their withholding. Whatever kind of travel is on your retirement wish list if you want it to happen you had better make sure that you set goals and budget for it as part of your overall retirement plan.

This calculator assumes that the year you retire you do not make any contributions to your retirement savings. Another factor overlooked by singles and married couples alike is the impact of taxes. Retirement income needs to be viewed on an after-tax basis.

The MSN retirement calculator in 2011 has as the defaults a realistic 3 per annum. Stashing away just a few hundred extra bucks a month in an IRA earns you. Thus spouses employment status may affect ones decision to retire.

To find a financial advisor who serves your area try our free online matching. Questions a Retirement Calculator for Couples Need to Ask. What LGBTQ couples need to know about retirement and estate planning whether married or not Published.

Montana taxes most forms of retirement income while taxing a portion of Social Security benefits for retirees above a certain income level. Here are tips for finding and using a retirement calculator for married couples or any couple. A good retirement calculator will give you separate fields one for you and one for your spouse or partner for each of the following topics.

Overview of Montana Retirement Tax Friendliness. Our Connecticut retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. On average husbands are three years older than their wives in the US and spouses often coordinate their retirement decisions.

Good scoring 26 out of 3 Scorecard Components. Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. The AARP Retirement Income Calculator estimates how much youre projected to have by a target retirement date and estimates the minimum amount youll likely needIt shows results in terms of yearly cash flow streams.

Newly married couples must give their employers a new Form W-4 Employees Withholding Allowance within 10 days. The NewRetirement retirement planning calculator allows you to. Connecticut Taxable Income Rate.

However from the time the couple get married they can only have one exemption although this may be divided between the two dwellings. The ability to add Social Security. High scoring 3 out of 3.

Property taxes in Montana are fairly low and there are no sales taxes there. Up to 85 of the Social Security benefits you receive can be taxed although never 100. Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more.

For married taxpayers filing separate returns the cap is 375000. For example if you retire at age 65 your last contribution occurs when you are actually age 64. Most people are married when they reach retirement age.

June 27 2022 at 1107 am. Susan bought a house in 2004. Youll need to input how much you extra you expect to get in the retirement income field.

Opening an individual retirement account IRA is one of the most effective ways to bolster your retirement strategy. Age at retirement Age at which you plan to retire. She lived in it until she married Roger in 2021 at which point they moved into his house which he.

In a married couple if one spouse works and the other spouse has zero earned income the working spouse is allowed to contribute double the normal limits to an IRA on behalf of their non-working.

What Are Marriage Penalties And Bonuses Tax Policy Center

What Is The Average Retirement Income For Married Couples

Retirement Calculator For Couples Married Or Not

The Average Net Worth For The Above Average Married Couple

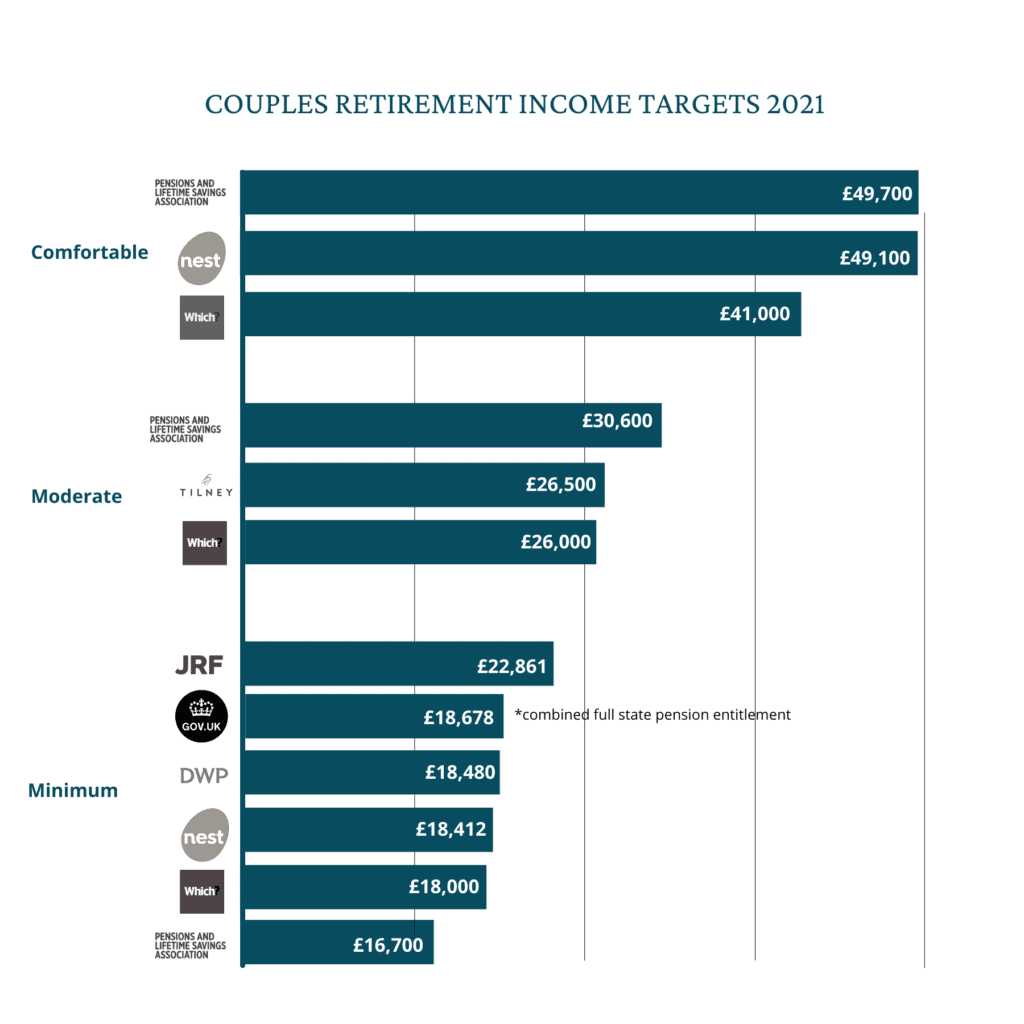

How Much Does A Married Couple Need To Retire Comfortably

How Much Money Do Couples Need For Retirement 2022

Average Retirement Savings For Married Couples By Age

The Average Net Worth For The Above Average Married Couple

Financial Goals For Married Couples To Conquer Together 9 Ideas

Life Insurance Company Offers Range Of Tools Life Insurance Premium Calculator To Help Life Insurance Calculator Financial Decisions Life Insurance Companies

3

1

Printable Freebie Your Free Printable Roadmap To Financial Independence Financial Independence Personal Financial Planning Financial

The Average Net Worth For The Above Average Married Couple

Retirement Planning For Couples

3

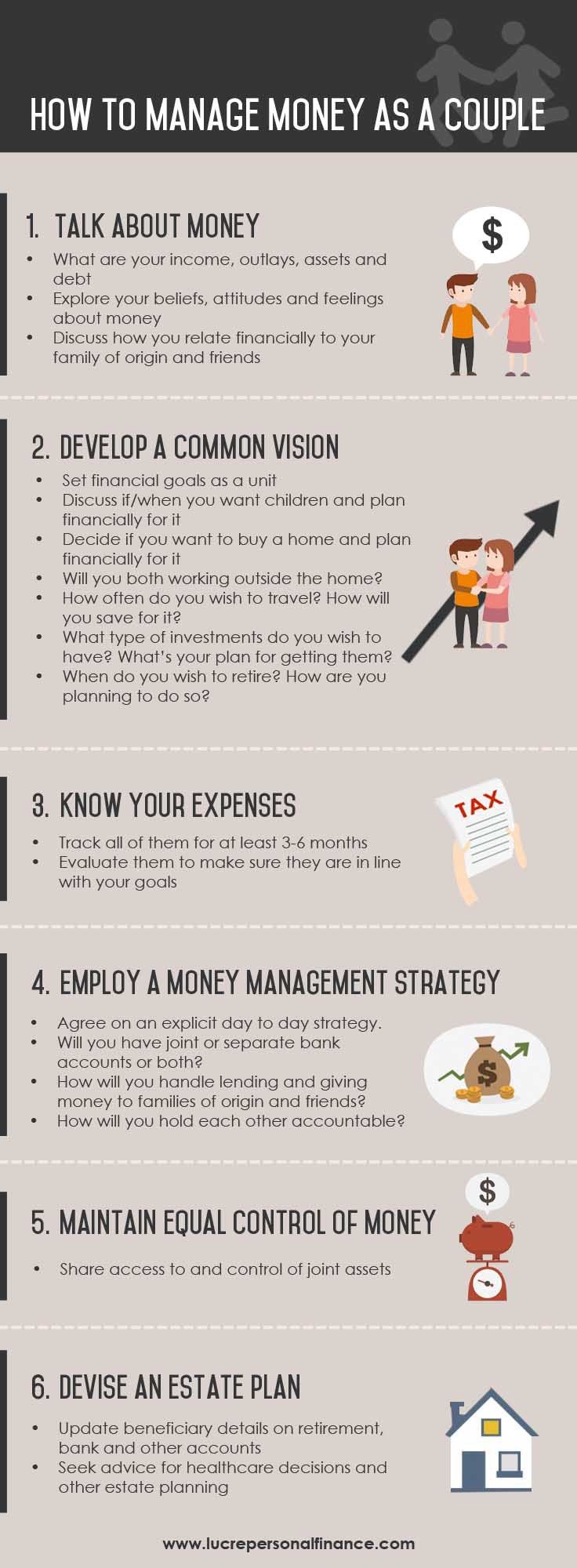

6 Keys To Mastering Money As A Couple Budgeting Money Money Management Personal Finance